The spread between the 10-year Treasury yields and 30-year fixed mortgage rates tightened at the end of 2025, largely driven by Fannie Mae and Freddie Mac increasing their holdings of mortgage-backed securities, a Keefe, Bruyette & Woods report claimed.

Processing Content

But a bigger picture issue overhanging the increase in portfolio size is should the government-sponsored enterprises be

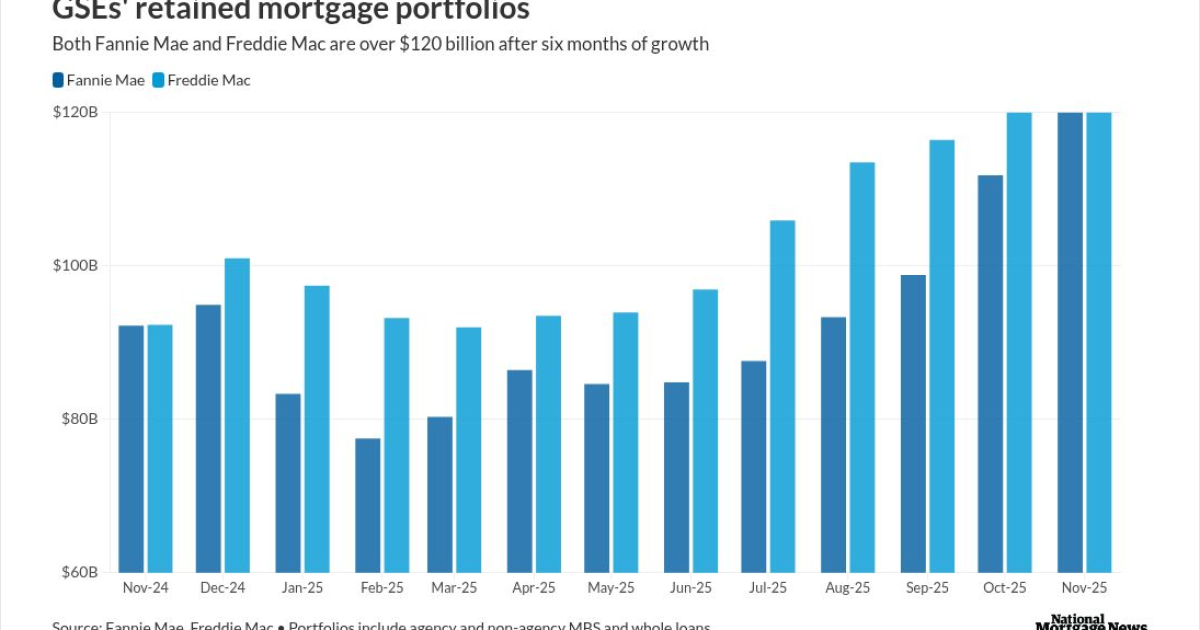

Fannie Mae and Freddie Mac portfolios are now almost equal in size, at $123.5 billion and $123.6 billion respectively, as of Nov. 30, 2025. This compares with $84.6 billion and $93.9 billion in May.

Fannie’s holdings only crossed over the $100 billion mark in November; Freddie’s did so in July.

How large can the GSE retained portfolios grow?

But even at this expanded size, the KBW report from Bose George noted that limits per

“Since there is meaningful room under the cap, we would expect continued buying from the GSEs in 2026 to keep spreads tight (or tighten them further) in order to support mortgage rates,” George wrote. “Further, since the PSPA is an agreement between FHFA and the U.S. Treasury, it could be amended to allow the GSEs to purchase more MBS, either temporarily or permanently.”

How have spreads changed since the start of 2025

As the GSEs have bought more securities as investments, the spreads between the agency MBS and the 10-year Treasury ended 2025 at 89 basis points. This compared with 126 basis points at the end of 2024, and 142 basis points in April 2025, George pointed out.

This is still 25 basis points higher than the pre-pandemic average from 2015 through the middle of 2019.

The spread

On Jan. 2, the 10-year closed at 4.19%, while the 30-year conforming averaged 6.14%, according to Optimal Blue, making the spread 205 basis points.

Some of the other reasons spreads could be narrowing

What could be playing a role in the spreads tightening is a continued low level of new securities issuances, said Steve Harris, managing director at Mortgage Industry Advisory Corp.

On the demand side, MBS, particularly private paper, is being bought not just by sovereign investors, but also international and domestic insurance companies.

“Less supply and more demand would, of course, tighten spreads,” MIAC’s Harris said.

While the increased MBS purchases are part of the story, it is

Goodman recently authored a paper with Jim Parrott, the owner of Parrott Ryan Advisors on the state of the securitization market after the Federal Reserve ended quantitative tightening and its role as a stabilizer. The paper concludes that neither the Fed nor the GSEs are well positioned to return to the role of buyer of last resort and the agency MBS market might have to get comfortable operating without a safety net.

For the GSEs, “they need to figure out what their long-term mission is first,” Goodman said.

What is the role of lower volatility in spread changes

Goodman pointed to the Merrill Lynch Option Volatility Estimate, or MOVE Index, to support this point of view.

At 62.36 as of Jan. 2, this index was down almost 30% over the past six months, according to Google, prior to the Trump Administration’s arrest of Venezuelan President Nicolas Maduro the following weekend.

The MOVE Index’s most recent low was on Dec. 26, when it was at 58.5.

Goodman pointed out that the retained portfolios really consists of three parts, including each company’s own securities, whole loans and other securities, both agency and non-agency.

While at Fannie, much of the growth has been in its own securities being added to the retained portfolio, at Freddie, it has been whole loans, which are less impactful to the spread.

“So I just think it’s important to draw a distinction between the agency securities and the rest of the portfolio,” she declared.

Another reason why spreads are tightening are the effects of Fed policy. Right now, people have a better idea of where the Fed stands on economic issues.

Mortgage rates have generally remained stable through much of the past six months.

These are all factors on why lower volatility has helped to tighten spreads. Goodman did not discount the GSE purchases but added the reduction in volatility “is a bigger explainer of the decline in mortgage spreads.” But, she added “there’s no definitive answer to that question.”

The potential for retained portfolio growth in 2026

Meanwhile, growing the retained portfolio would be accretive to both GSEs’ earnings, which George described as a “modest positive” when it comes

“We would expect GSE buying of agency MBS to continue in 2026 as a tool for supporting mortgage rates, which is likely to support spreads and agency MBS REIT book values,” George said.

Publisher: Source link